The minimum alternative tax mat is a provision introduced in direct tax laws to limit the tax deductions exemptions otherwise available to taxpayers so that they pay a minimum amount of tax to the government.

What is mat tax guru.

Therefore mat credit provisions ensure that the company will always pay a minimum tax called mat.

Minimum alternative tax mat and its computation of book profit and mat credit under section 115jb of income tax act 1961.

Deferred tax is the tax effect of timing differences.

Pursuant to new section 115baa as in the income tax act 1961 the domestic companies have the option to pay tax 22 from the fy 2019 20 ay 2020 21 onwards if such company adhered to certain specified conditions including the condition inserted by section 115jaa 8 whereby the company will have to write off mat credit if it has to switch.

The effective tax rate for such companies will be 25 17 per cent inclusive of all surcharge and cess.

Mat is a tax provision reintroduced in 1997 in an attempt to bring zero tax high profits companies into the income tax net.

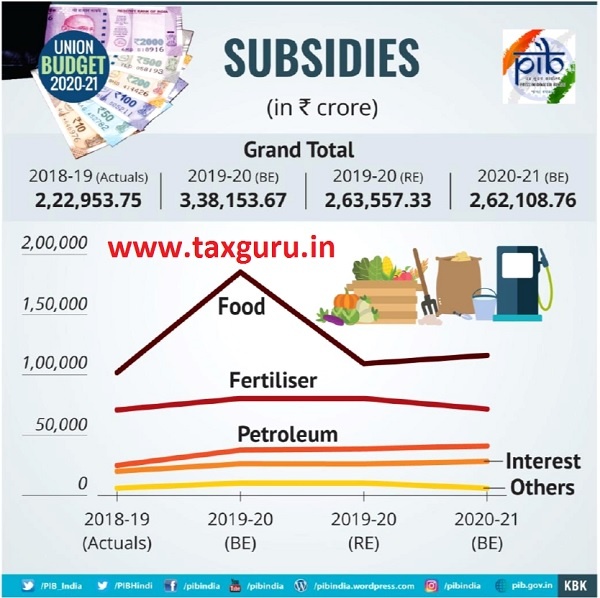

Tax guru is a reliable source for latest income tax gst company law related information providing solution to ca cs cma advocate mba taxpayers.

The tax liability of a company will be higher of.

Such companies shall not be required to pay minimum alternate tax mat.

Report from ca to be furnished electronically as per rule 12 2 in form 29b to certify book profits are computed as per sec 115jb.

Book profit of the company is rs.

Applicability of mat mat is applicable to all companies including the foreign companies.

8 40 000 will amount to rs.

On minimum alternate tax mat alternate minimum tax amt a mat was introduced for the first time in the ay 1988 89.

Current tax is the amount of income tax determined to be payable recoverable in respect of the taxable income tax loss for a period.

Normal tax rate applicable to an indian company is 30 plus cess and surcharge as applicable.

Report of a accountant for mat.

Minimum alternate tax mat rates for the a y.

It was felt that due to various concession provided in tax laws big corporate groups become zero tax companies.

Timing differences are the differences between taxable income and accounting income for a period that originate in one period and are capable of reversal.

Tax 30 on rs.

Analysis of provision of section 115jb where in case of a company the income tax payable on the total income as computed under the income tax act in respect of any previous year is less than 15 of its book profit then such book profit shall be deemed to be the total income of the assessee and the tax.